The Home Depot vs. Lowe’s

A Quick Look at Q4 2024 Earnings & 3-Year Performance Trends

The rivalry between The Home Depot and Lowe’s remains one of the most closely watched in the retail industry. As the two largest home improvement retailers in the world, both companies face the same market conditions, consumer demand shifts, and supply chain challenges. Yet, their strategies, execution, and financial results often differ. Why is that? To answer this question, let’s look at Q4 2024.

Q4 Snapshot

The Headline: They make their differences their strength!

The Home Depot outperformed Lowe’s in revenue and same-store sales, benefiting from its strong Pro Business. And Lowe’s showed strong margin expansion due to cost controls and efficiency initiatives; essentially, they've improved profitability through cost savings and margin driving programs. In other words, both retailers continue to focus on their strengths.

Key Performance Factors

A key difference between the two centers around their respective growth drivers.

The Home Depot

Pro Focus – Continues to invest in Pro Loyalty Programs and Services such as job-site delivery

Supply Chain Enhancements – Opened new Distribution Centers to improve inventory efficiency

E-commerce Growth – Expanding digital tools, including AI-powered shopping recommendations

Sustainability Growth – Introducing new eco-friendly product lines, enhancing ESG commitments

Lowe’s

DIY & Homeowner Focus – Strengthening its DIY segment with exclusive product launches across Stainmaster and Kobalt brands

Cost-Cutting Measures – Streamlining store operations, improving profitability

Omnichannel Expansion – Continues to invest in omnichannel services such as BOPIS (Buy Online, Pickup In-Store) and same-day delivery

Private Label Growth – Launching additional proprietary brands such as Essentials to drive margin

The last quarter of 2024 reflected the strategic approach we’ve seen with each retailer over the last 3 years. The Home Depot has capitalized on their Pro customer base, while Lowe’s has doubled down on DIY customers and cost efficiency initiatives.

3 Year Snapshot

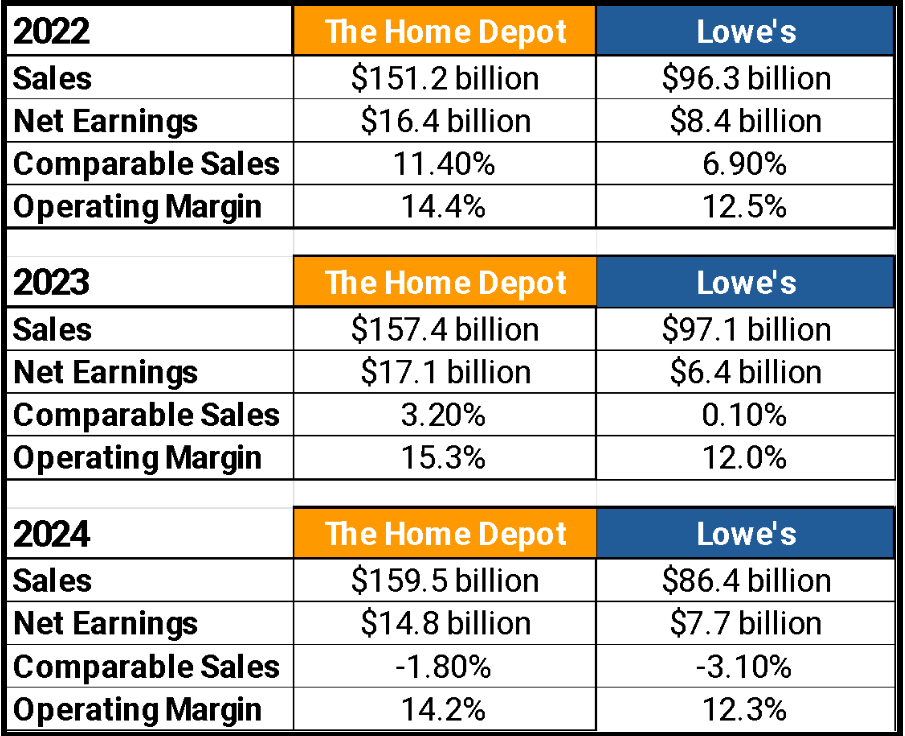

Same-Store Sales Growth

Both companies have always viewed Same Store Sales Growth (Comps) as the most critical measure of performance. Comps give true insight into customer retention, store execution, and traffic. Over the last 3 years Home Depot has outperformed Lowe’s in Comps, highlighting strong execution in the Pro and online segments. Lowe’s has focused on investing in supply chain and digital tools which have shown promise in boosting their efficiencies and traffic. Ultimately, despite their maturity both companies are still “hungry for comps,” and working to focus on the customer.

Profitability & Margin Trends

Another key comparison metric is Gross Margin rate. The Home Depot has maintained higher margins driven by strong supplier relationships and efficient cost management. Lowe’s has improved operating margin through cost-cutting and efficiency programs. Moving forward, both companies will see margin pressure from inflation, tariff issues and supply chain disruptions, but both will undoubtedly continue to drive growth with their proven strategies.

Ultimately Everyone Wins!

It's Coke vs. Pepsi or Microsoft vs. Apple rivalry…each company strong, but strong in different ways. The Home Depot and Lowe’s have each shown resilience in challenging economic climates with positive comp sales growth and strategic initiatives aimed at sustaining their market positions.

The Home Depot remains the stronger performer overall, especially due to its contractor business and systems superiority. However, Lowe’s continues to narrow the gap with cost-cutting and omnichannel expansion.

Investors and consumers alike should watch this space in 2026.